san francisco gross receipts tax 2021 due dates

San Francisco Set to Begin 2021 With Gross Receipts Tax Increase. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

San Francisco Gross Receipts Tax

To begin filing your 2021 Annual.

. Jun 25 2022 San francisco gross receipts tax 2021 due dates. Additionally businesses may be subject to up to four local San Francisco taxes. Beginning in 2014 the.

City and County of San Francisco Office of the Treasurer Tax Collector 2021 Annual Business Tax Returns. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of. Additionally businesses may be subject to up to four local San Francisco taxes.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts. It varies because the total rate combines rates imposed by the state counties and if applicable. San francisco gross receipts tax instructions Tuesday March 15 2022 Edit However the gross receipts of an airline or other person engaged in the.

The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor.

2021 Annual Business Tax Returns. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor. Additionally businesses may be subject to up to three city taxes.

City and County of San Francisco 2000-2021. Annual Business Tax Returns 2021 The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of.

Feb 28Payroll Expense Tax and Gross Receipts Tax returns due. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. Mar 31Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health.

Estimated tax payments due dates include April. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. 555 Capitol Mall Suite 765 Sacramento CA 95814.

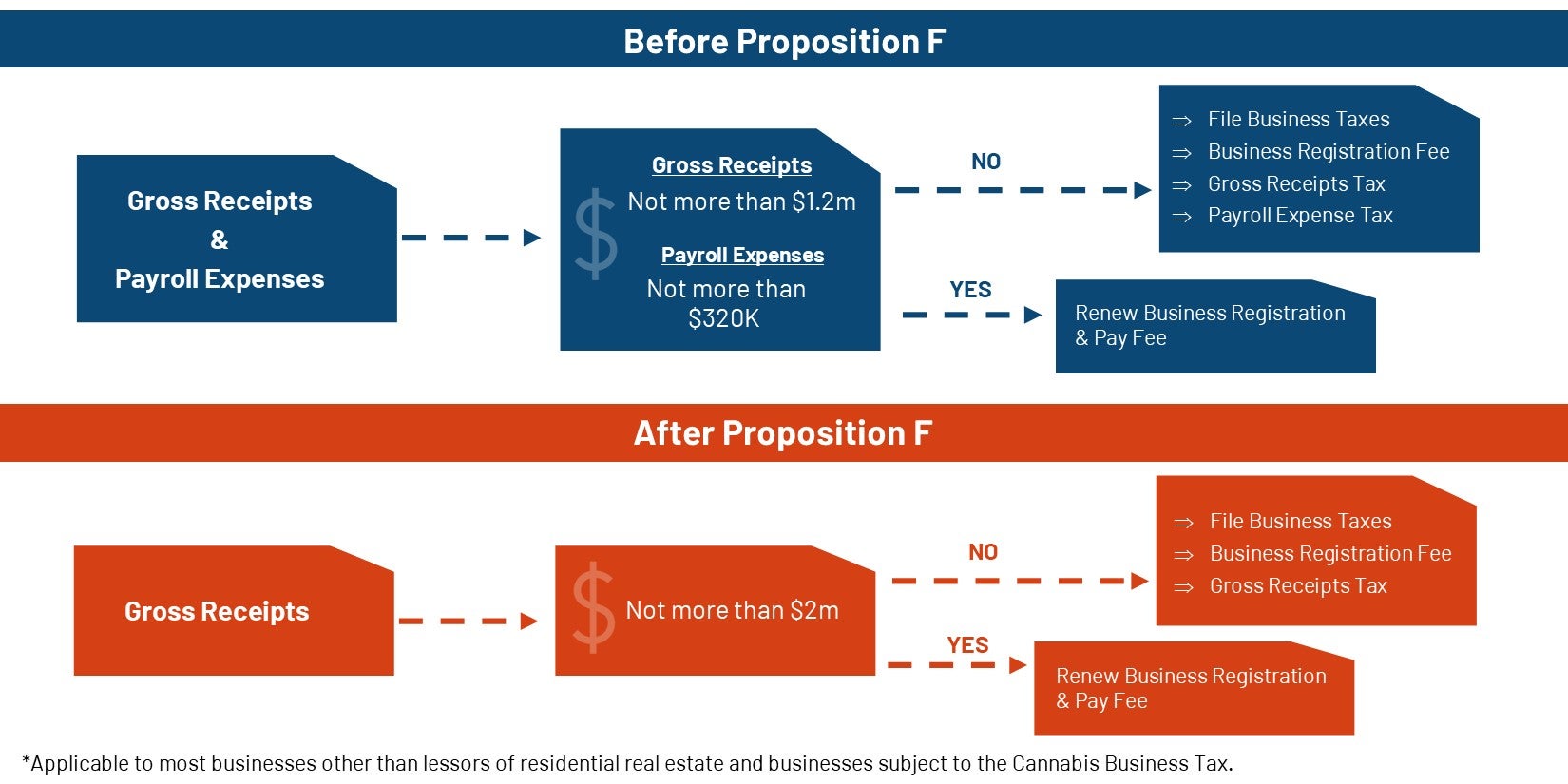

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

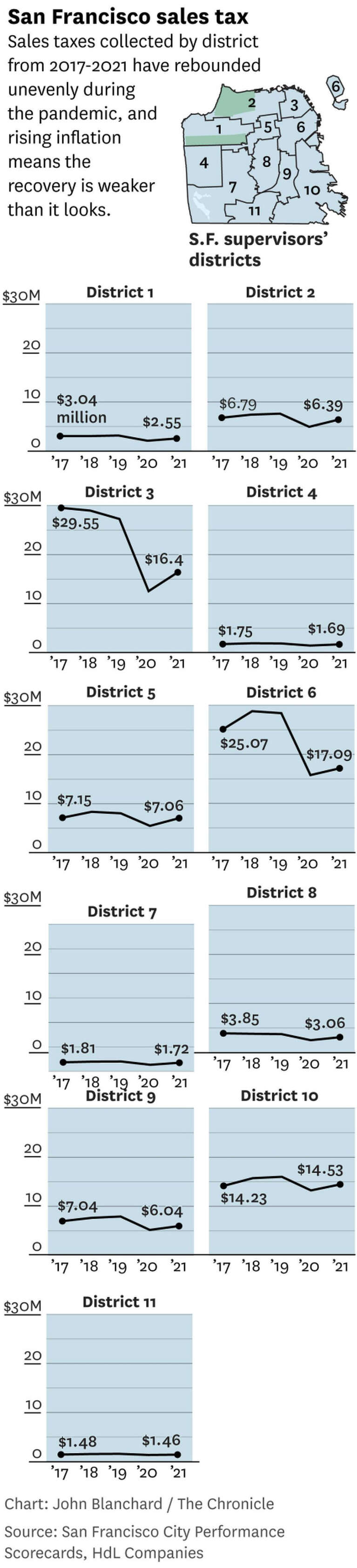

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Secured Property Taxes Treasurer Tax Collector

Free Paycheck Stub Template Check On Top Format Payroll Check Printed By Ezpaycheck Payroll Payroll Checks Payroll Software Payroll

Key Dates Deadlines Sf Business Portal

Shipping Label Template Online Awesome Utility Bill Template Spreadsheet Examples Gas Sample Uk Bill Template Label Templates Business Template

Gig Workers Need To Get Ready For Tax Forms Protocol

San Francisco Taxes Filings Due February 28 2022 Pwc

Value Added Tax Vat In Uae Cement Wall Picture Cube Wooden Blocks

Annual Business Tax Returns 2021 Treasurer Tax Collector

Pin On Helping People With Disabilities

Profit And Loss Template For Excel Profit And Loss Statement Statement Template Profit

Pin By Cassandra Jennings On Payroll Template Credit Card App Credit Card Statement Business Checks

Non Profit Budget Template Budget Template Budgeting Budgeting Worksheets

What Are Gross Receipts Definition Uses More

Secured Property Taxes Treasurer Tax Collector

State Of Michigan Payroll Schedule Image State Of Michigan Sales Techniques Payroll

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time